Medical Mileage Deduction 2024. Meal and vehicle rates used to calculate travel expenses. The 2023 standard mileage rate is 22¢ per mile.

Treatment for drug use or alcoholism: 21 cents per mile driven for medical.

The 2023 Standard Mileage Rate Is 22¢ Per Mile.

We review how to anticipate 2024 income with deductions for business or medical use of a car.

For 2023, The Standard Mileage Rate For The Cost Of Operating Your Car For Business Use Is 65.5 Cents ($0.655) Per Mile.

17 rows the standard mileage rates for 2023 are:

Medical Mileage Deduction 2024 Images References :

Source: allegrawceline.pages.dev

Source: allegrawceline.pages.dev

How To Calculate And Claim Mileage Deductions In 2024? Alina Beatriz, 17 rows the standard mileage rates for 2023 are: The irs mileage rates, pivotal for anyone who uses a vehicle for business, charitable, medical, or moving purposes, have undergone notable changes this year.

Source: reebaqhonoria.pages.dev

Source: reebaqhonoria.pages.dev

Standard Mileage Deduction For 2024 Hadria Analiese, Discover how to maximize tax savings by deducting medical and dental expenses. The 2023 standard mileage rate is 22¢ per mile.

Source: susannewtomi.pages.dev

Source: susannewtomi.pages.dev

Mileage Rate 2024 Medical Lauri Moselle, 17 rows the standard mileage rates for 2023 are: Treatment for drug use or alcoholism:

Source: bettyqminerva.pages.dev

Source: bettyqminerva.pages.dev

Medical Mileage Rate 2024 Eula Laurella, This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). 21 cents per mile driven for medical.

Source: expressmileage.com

Source: expressmileage.com

Medical Mileage Deduction on you taxes ExpressMileage, Standard medical mileage rates, parking fees, tolls, and other qualified transportation amounts. We review how to anticipate 2024 income with deductions for business or medical use of a car.

Irs Mileage Rate 2024 Medical Travel Kiri Ophelie, Meal and vehicle rates used to calculate travel expenses. The irs mileage rates, pivotal for anyone who uses a vehicle for business, charitable, medical, or moving purposes, have undergone notable changes this year.

Source: pierbgeorgianne.pages.dev

Source: pierbgeorgianne.pages.dev

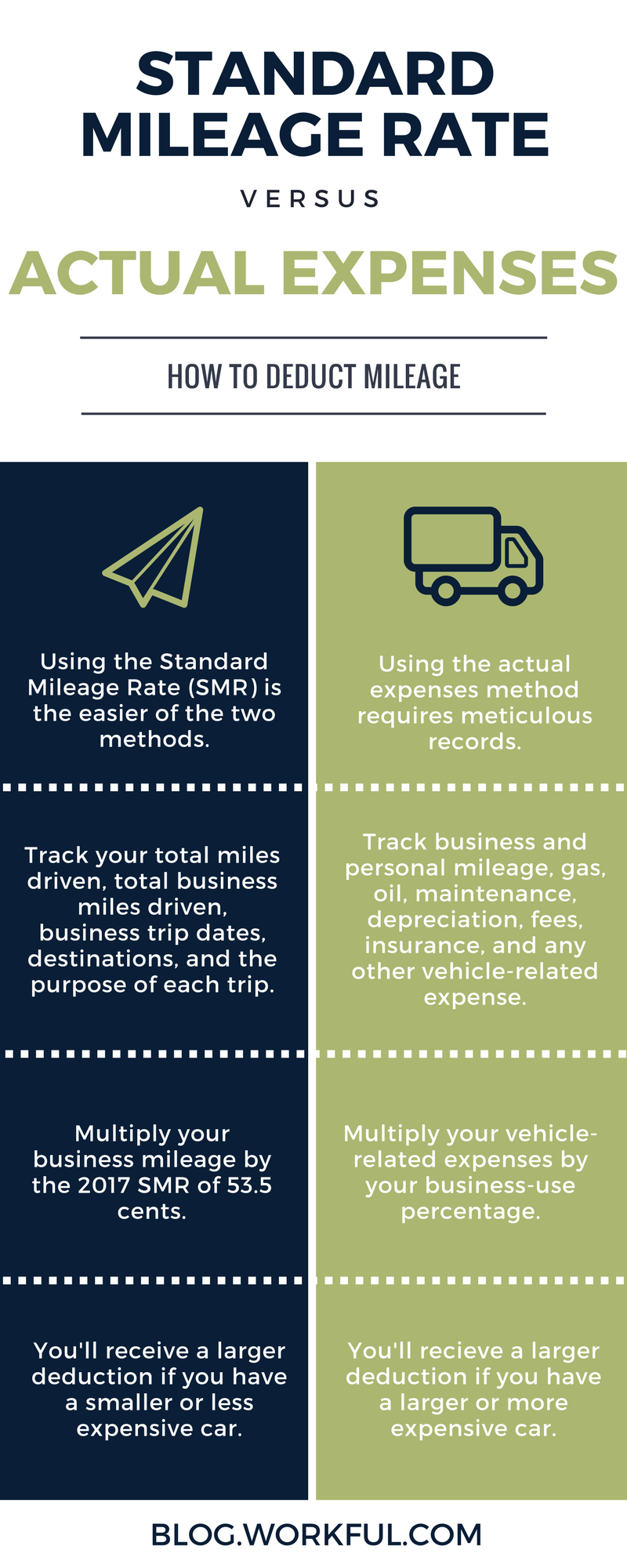

2024 Tax Medical Deductions Flore Jillana, The 2023 standard mileage rate is 22¢ per mile. There are two ways you can work out your medical mileage:

Source: patricewrivy.pages.dev

Source: patricewrivy.pages.dev

Medical Bills Tax Deduction 2024 Josi Rozele, Our 2024 mileage deduction calculator uses standard irs mileage rates to calculate your mileage deduction for taxes or reimbursement. 17 rows the standard mileage rates for 2023 are:

Source: www.pinterest.com

Source: www.pinterest.com

Deduction, Mileage, Need To Know, Everything, Medical, Business, 2024 standard mileage rates overview. The rates for 2024 will be available on our website in 2025.

Source: expressmileage.com

Source: expressmileage.com

How to Claim Your Medical Care Expense Deduction ExpressMileage, Beginning january 1, 2024, the standard mileage rates for the use of a car (which includes vans, pickups and panel trucks) is: The irs set the following standard mileage rates for 2024:

The Irs Set The Following Standard Mileage Rates For 2024:

We review how to anticipate 2024 income with deductions for business or medical use of a car.

The Medical Mileage Rate Set For 2024 Is 21 Cents Per Mile.

While the 2024 business standard mileage rate has increased, the medical mileage rate of 21 cents per mile (which may be deductible under internal revenue code § 213 if it is.

Posted in 2024